The Journey from 0 to 1, from Mosaic to Netscape

As part of a new series where we will share select a16z partner appearances on other podcasts with our audience here, this episode is cross-posted from the new show Starting Greatness -- featuring interviews with startup builders before they were successful -- hosted by Mike Maples junior.In the conversation, a16z co-founder Marc Andreessen shares some rare, behind-the-scenes details of his story from 0 to 1 -- from the University of Illinois and Mosaic to Netscape -- and along the journey, really, to product-market fit... Stay Updated:Find a16z on XFind a16z on LinkedInListen to the a16z Podcast on SpotifyListen to the a16z Podcast on Apple PodcastsFollow our host: https://twitter.com/eriktorenberg Please note that the content here is for informational purposes only; should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security; and is not directed at any investors or potential investors in any a16z fund. a16z and its affiliates may maintain investments in the companies discussed. For more details please see a16z.com/disclosures. Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

17 Dec 201944min

Direct Listings, Myths and Facts

We’ve covered a lot of the strategic financing milestones for startups seeking to build a sustainable and enduring business -- from mindsets for startup fundraising to when and how to build a finance functionwith a CFO to what it takes to do an initial public offering (IPO) and stories from the inside out. There’s also a lot that goes on behind the scenes en route to IPO, including how they’re priced and what the "pop" means.Yet another route to the public markets is the direct listing, recently reinvented for tech companies (with Spotify and Slack so far). We explained the process and tradeoffs in this early primer by Jamie McGurk, so this episode of the a16z Podcast brings together two experts from the frontlines: the architect of the direct listings in their current form, Barry McCarthy, current CFO of Spotify (and former CFO of Netflix); and Stacey Cunningham, president of the NYSE where they were listed -- in conversation with Sonal Chokshi to share more about the what, the how, and the why from an insider perspective.What's the bigger picture here, including secular shifts in the public and private markets? Zooming in closer, what are all the details and nuances involved in true pricing, investor days, forward guidance, and other market mechanisms for "radical transparency"? What did it take behind the scenes to make this all happen, and what's still happening? And finally, what are some of the common myths and misconceptions around direct listings (and IPOs) as methods for going public? Turns out, there's a lot that goes into making markets... and market making.---The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information. Stay Updated:Find a16z on XFind a16z on LinkedInListen to the a16z Podcast on SpotifyListen to the a16z Podcast on Apple PodcastsFollow our host: https://twitter.com/eriktorenberg Please note that the content here is for informational purposes only; should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security; and is not directed at any investors or potential investors in any a16z fund. a16z and its affiliates may maintain investments in the companies discussed. For more details please see a16z.com/disclosures. Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

11 Dec 201944min

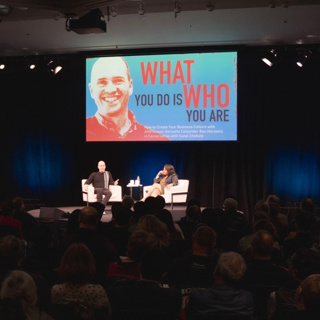

The Stories and Code of Culture Change

There are some common tropes that can kill your company culture -- whether it's that corporate values can be weaponized; "fake it til you make it"; the "reality distortion fields" of visionaries vs. liars; and so on. All of this just reveals the confusing, sometimes blurry line between the yellow zones and red zones of behavior, because the very things that are strengths can also become weaknesses (and vice versa!). The fact is, in any complex adaptive system (which is what a company is), even the seemingly smallest behaviors will move the culture where the loudest proclamations do not.That's why so much of culture -- whether building and setting it or fixing and changing it -- comes down to the difference between actions and words, to the tacit vs. the explicit, to the difference between what you do vs. what you say (and what employees see vs. what they hear). So in this episode of the a16z Podcast, based on a conversation that recently took place at the Computer History Museum in Silicon Valley, Sonal Chokshi interviews Ben Horowitz about his new book, What You Do Is Who You Are, probing on all the tricky nuances of the themes covered in it -- and also how to practically apply principles from it to the tech industry and beyond.Are mistakes of omission more important than mistakes of commission, when it comes to ethical lines? What can employees, not just leaders, do when it comes to culture? Where does the idea of "culture fit" come in? What happens when startups go from being the pirates to being the navy? Drawing on examples of culture as code from a thousand years ago to today -- spanning empires, wars, revolutions, prisons, and even hip-hop -- Horowitz shares the power of song and story. Including even violent, "shocking" ones that reset cultures... because they make you ask, WHY?!100% of the proceeds from the book will go to anti-recidivism, and to making Haiti great again Stay Updated:Find a16z on XFind a16z on LinkedInListen to the a16z Podcast on SpotifyListen to the a16z Podcast on Apple PodcastsFollow our host: https://twitter.com/eriktorenberg Please note that the content here is for informational purposes only; should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security; and is not directed at any investors or potential investors in any a16z fund. a16z and its affiliates may maintain investments in the companies discussed. For more details please see a16z.com/disclosures. Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

7 Dec 201959min

Of Container Ships, Supply Chains, and Retail

This podcast rerun -- first recorded over two and a half years ago, now being rerun as one of our evergreen classics on the tails of the world's largest designated shopping days (Black Friday, Singles Day in China, Prime Day online, and so on) -- is ALL about the container ship. Also known as "The Box", with author Marc Levinson (in conversation with Sonal Chokshi and Hanne Tidnam). But this episode is really about connecting the dots between logistics, transportation, infrastructure, and much more.What do we make of the so-called "death of retail", especially when seen through the retail history of the once-largest retailer in the world? How are supply chains changing today? One thing's for sure: the shipping container made the world much smaller... and the world much economy bigger. image: Kevin Talec / Flickr Stay Updated:Find a16z on XFind a16z on LinkedInListen to the a16z Podcast on SpotifyListen to the a16z Podcast on Apple PodcastsFollow our host: https://twitter.com/eriktorenberg Please note that the content here is for informational purposes only; should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security; and is not directed at any investors or potential investors in any a16z fund. a16z and its affiliates may maintain investments in the companies discussed. For more details please see a16z.com/disclosures. Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

3 Dec 201933min

Nursing Today, From the Bedside and Beyond

"Constant attention by a good nurse may be just as important as a major operation by a surgeon”, diplomat Dag Hammarskjöld once observed -- and that may be more true today than ever before. For most of us, nurses are essentially the face of the healthcare system: the person you’ll see the most of while you’re in it, who will monitor your vitals, administer medications, hold your hand when you’re in pain or scared, answer all the questions you forgot to ask the doctor.So in this episode, we take a look at the role of that unsung hero of healthcare -- the nurse -- at an industry level. Iman Abuzeid, CEO and co-founder of Incredible Health (a hiring platform for nurses), and a16z general partners Julie Yoo and Jeff Jordan discuss with Hanne Tidnam how the scope of the job is changing today and why; what’s driving the looming nursing shortage crisis, and ways we can help solve it; what it’s like to build a new marketplace platform in healthcare; and how best to introduce innovation into the healthcare system overall. Stay Updated:Find a16z on XFind a16z on LinkedInListen to the a16z Podcast on SpotifyListen to the a16z Podcast on Apple PodcastsFollow our host: https://twitter.com/eriktorenberg Please note that the content here is for informational purposes only; should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security; and is not directed at any investors or potential investors in any a16z fund. a16z and its affiliates may maintain investments in the companies discussed. For more details please see a16z.com/disclosures. Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

28 Nov 201932min

How We Podcast

"Hi everyone, welcome to the a16z Podcast..." ... and welcome to our 500th episode, where, for the first time, we reveal behind-the-scenes details and the backstory of how we built this show, and the broader editorial operation. [You can also listen to episode 499, with head of marketing Margit Wennmachers, on building the a16z brand, here.]We've talked a lot about the podcasting industry, and even done podcasts about podcasting, so for this special episode, editor-in-chief and showrunner Sonal Chokshi reveals the how, what, and why in conversation with a16z general partner (and guest-host for this special episode) podcasting fan Connie Chan. We also answer some frequently asked questions that we often get (and recently got via Twitter), such as:how we program podcastswhat's the process, from ideas to publishingdo we edit them and how!do guests prep, do we have a scripttechnical stack...and much more. In fact, much of the conversation goes beyond the a16z Podcast and towards Sonal's broader principles of 'editorial content marketing', which hopefully helps those thinking about their own content operations and podcasts, too. Including where podcasting may be going.Finally, we share some unexpected moments, and lessons learned along the way; our positions on "tics", swear-words, and talking too fast; failed experiments, and new directions. But most importantly, we share some of the people behind the scenes who help make the a16z Podcast what it was, is, and can be... with thanks most of all to *you*, our wonderful fans! Stay Updated:Find a16z on XFind a16z on LinkedInListen to the a16z Podcast on SpotifyListen to the a16z Podcast on Apple PodcastsFollow our host: https://twitter.com/eriktorenberg Please note that the content here is for informational purposes only; should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security; and is not directed at any investors or potential investors in any a16z fund. a16z and its affiliates may maintain investments in the companies discussed. For more details please see a16z.com/disclosures. Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

27 Nov 201947min

Brand Building Ideas… and People

Many technical founders, academics, and other experts often believe that great products -- or great ideas! -- sell themselves, without any extra effort or marketing. But in reality, they often need PR (public relations).The irony is, most of the work involved in PR is actually invisible to the public -- when it works, that is -- and therefore hard for those from the outside to see let alone understand. So how does such brand-building really work? In this 10-year anniversary episode of the a16z Podcast (and our 499th episode), a16z operating partner Margit Wennmachers shares the case study of her work at The Outcast Agency (which she co-founded) and of building the a16z brand (where she heads marketing and was the first and one of the earliest hires).What's the backstory there? What's the backstory behind some of the most popular media stories and op-eds -- like "software is eating the world" -- and what can it teach us about how PR and brand-building works in practice? Because -- like many software companies -- the product is so abstract, and not something you can physically touch, what kind of subtle decisions and tactics big and small does it take? Answering some frequently asked questions (in conversation with editor in chief Sonal Chokshi) that we often get around how things work, Wennmachers reveals (just some;) of the details behind the scenes. Given that technology is all about disintermediating "brokers" in the middle, will tech one day replace PR? And finally, what's the hidden Silicon Valley network mafia that NO one talks about? Stay Updated:Find a16z on XFind a16z on LinkedInListen to the a16z Podcast on SpotifyListen to the a16z Podcast on Apple PodcastsFollow our host: https://twitter.com/eriktorenberg Please note that the content here is for informational purposes only; should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security; and is not directed at any investors or potential investors in any a16z fund. a16z and its affiliates may maintain investments in the companies discussed. For more details please see a16z.com/disclosures. Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

20 Nov 201935min

Come for the Games, Stay for the Party

The games industry is in the midst of a tectonic shift. Powered by platform convergence, games-as-a-service, and user-generated content, modern video games—what we call next-generation games—are unlike anything we've seen before. In the past decade, gaming has grown from a niche hobby into a global, culture-defining phenomenon.Not only are the games themselves becoming increasingly immersive, the way we develop and discover them has fundamentally changed. In contrast to the hits-driven business model of the past, now games are shaped in real time by player feedback. And thanks to the rise of influencer gamers, the experience of finding new games has become organic and social.In this episode, a16z general partner Andrew Chen, deal partner Jon Lai, and host Lauren Murrow discuss how gaming is dominating not only the entertainment industry, but also pop culture at large. (Why can't we quit you, Untitled Goose Game?!) Andrew and Jon share how they think about emerging technologies in the space, as well as the features they look for in next-gen games and game developers. Stay Updated:Find a16z on XFind a16z on LinkedInListen to the a16z Podcast on SpotifyListen to the a16z Podcast on Apple PodcastsFollow our host: https://twitter.com/eriktorenberg Please note that the content here is for informational purposes only; should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security; and is not directed at any investors or potential investors in any a16z fund. a16z and its affiliates may maintain investments in the companies discussed. For more details please see a16z.com/disclosures. Hosted by Simplecast, an AdsWizz company. See pcm.adswizz.com for information about our collection and use of personal data for advertising.

2 Nov 201922min